You are making your money do what you desire it to do, rather than spending without a strategy. The goal of budgeting is to constantly spend less than you make. When you create a budget, you designate every dollar you earn to a spending category. You can utilize a spending plan to: Reduce your spendingUnderstand where your cash is goingIdentify bad financial habitsPay off debtAvoid creating new debtPrioritize costs on things that are very important to youSave for the future Budgeting is not a timeshare cancel one-time action.

You might require to adjust your budget plan from month to month to account for large expenses or your own spending habits. When you know just how much earnings you have, you can decide where to put it. When you are purposeful about where you invest it, you are in control of your cash.

When you owe money, you pay more than the cost of the initial purchase. You also have to make interest payments that can significantly cut into your income. Debt implies your cash isn't working for you, it's going towards paying that interest. It creates a monetary burden and restricts the options that you can make.

You can put it toward other monetary goals, such as conserving for education, producing a retirement fund, traveling, or improving your living scenario. You can start a business. You can begin investing it, allowing you to grow your wealth and produce more monetary stability and self-reliance. If you have a great deal of debt and are feeling overwhelmed, you can use the snowball approach to manage the debt payment process.

Everything about How Do I Make Money On M1 Finance

Put whatever additional money you have towards paying off the smallest debt. Once it's paid off, move onto the next tiniest. As you settle your smaller sized financial obligations, you'll have more money available to settle your larger financial obligations. This momentum helps you focus your efforts and get out of debt more quickly.

An unforeseen vehicle repair, a medical procedure, a job loss, or any other monetary emergency can rapidly send you spiraling into brand-new or more debt, cleaning out any progress you have actually made towards taking control of your cash. Developing an emergency situation fund is another method to make your cash work for you due to the fact that it suggests you have actually prepared for surprises.

Developing an emergency fund can take time. Preferably, you ought to save the equivalent of three to 6 months' worth of earnings. However every little bit you can set aside will assist. If you are still paying off debt or don't have much wiggle space in your spending plan, reserved whatever you can in a "surprise expenditures" classification in your budget.

Put your emergency situation cost savings in a high-yield savings account, which will earn more interest than a regular saving or inspecting account. This indicates that the cash you save will earn money while it's sitting in your savings account. If your bank doesn't provide high-yield accounts or you reside in a rural location without a bank, search for electronic banking choices to open an account.

The Only Guide to How Much Money Can You Make In Corporate Finance

Once you have released up all that money from settling your debt, you can put your money to resolve cost savings and investments. What you save for will depend upon your age, lifestyle, and goals. In addition to an emergency situation fund, you will also need retirement accounts. You should likewise consider whether you require: Education cost savings, on your own or your childrenTravel savingsA deposit fund for a houseSavings to begin a businessA vehicle fund, for repair work or a brand-new vehicleExtracurricular fund for dependentsLong-term care savings, for yourself or dependents By producing designated cost savings funds, you can track your development toward particular goals.

Keep in mind, when you pay interest, you are losing money. But when you make interest, your money is making more money all by itself. If you won't require your cost savings for numerous years or years, among the finest ways to make your money work for you is to invest. When you put your money into investments, it grows all by itself through interest or the increased value of the thing you purchased.

Investing is a long-term method for constructing wealth. The most effective financiers invest early, then allow their cash to grow for years or years prior to utilizing it http://ricardoawij247.bravesites.com/entries/general/the-basic-principles-of-how-to-make-a-lot-of-money-with-finance-blog as income. Continuously buying and offering investments is likely to make less money than a buy-and-hold strategy in the long run. As you start investing, it is very important to diversify your portfolio.

If that single financial investment fails, all your money might be gone. Instead, spread that risk out by purchasing a mix of: Exchange-traded funds (ETFs)Government bondsMutual fundsBusiness (your own or someone else's) Numerous shared funds or brokerage companies have a minimum quantity for first-time financiers. You may require to conserve up that minimum amount prior to you begin investing.

What Does How Much Money Can You Make With A Finance Degree And A Comuter Science Minpr Mean?

No matter how you are conserving or investing, have a particular set of goals. Know what you are working towards, like spending for your child's education, purchasing a home, or early retirement. This will help focus your spending and offer you inspiration, as well as helping you choose what types of financial investment are the very best for you.

The information is being presented without consideration of the investment goals, risk tolerance, or monetary scenarios of any specific investor and might not appropriate for all investors. Previous performance is not indicative of future outcomes. Investing involves risk, consisting of the possible loss of principal.

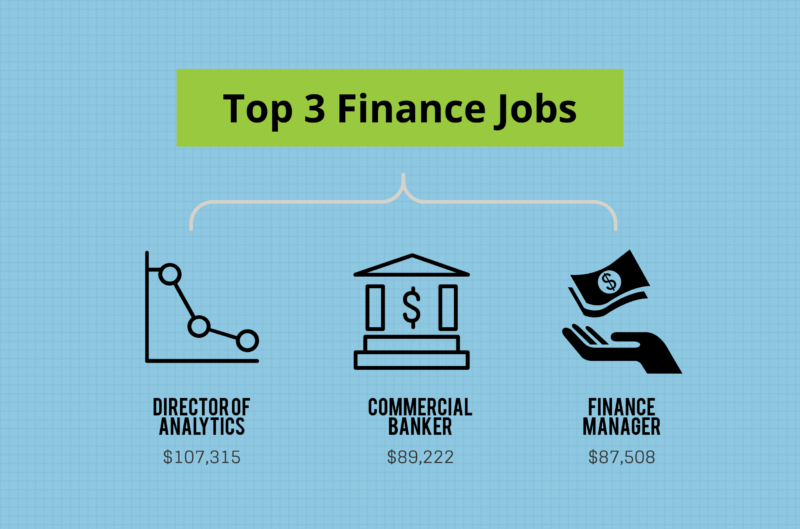

Finance jobs can be incredibly financially rewarding occupations for individuals who have strong mathematical and analytics skills. The industry of finance is broad and includes whatever from banking and financial investments to monetary technology, or Fintech, as it's typically understood. If you have actually been considering beginning a career in financing however are unsure of which method to go, you remain in the right location.

Finance offers a motivating number of chances to specialize for people who are interested in the field. These high-paying opportunities exist in among six categories, as described below: These are presidents and other jobs at business services and corporations both public and personal. These kinds of jobs are typically in a workplace and hold more conventional hours.

The Only Guide for Personal Finance How To Make Money

Advisors require to combine monetary expertise with sales acumen. Financial innovation represents monetary programmers and even a few of what CFOs do. In today's normal enterprise company, finance departments support innovation infrastructure permitting Fintech to overlap a number of other occupations in finance. Financial experts who work in investments are accountable for putting capital into portfolios that assist people and business development wealth.

Individuals who work in providing aid consumers choose loans, or perform some of the operational duties of helping clients protected loans. Easily apply to jobs with an Undoubtedly ResumeHere are the greatest paying finance tasks: Investment lenders manage the portfolios of organizations and federal government agencies that purchase a number of various organizations. Take a look at my Ultimate Guide to Personal Finance for tips you can execute TODAY. A 401k permits you to invest money for retirement AND get totally free money from your company while doing so. Here's how it works: Each month, a part of your pre-tax pay is invested automatically into the 401k.

You aren't taxed on your incomes up until you withdraw it at retirement age (59 years old). This suggests that you'll make more with compounding over your life time. Imagine you make $100,000/ year and your business provides you a 3% match on your 401k. If you invest $3,000 (3% of $100,000), your company will match you that much in your 401k.

In 2019 the contribution limitation for a 401k is $19,000. Maxing it out is a remarkable objective to have. Make certain to make the most of your employer's 401k plan by putting a minimum of enough money to collect the company match into it. This guarantees you're taking complete advantage of what is essentially free money from your company.

Top Guidelines Of What Finance Jobs Make The Most Money

If you're worried about your individual financial resources, you can enhance them without even leaving your couch. Have a look at my Ultimate Guide to Personal Finance for pointers you can carry out TODAY. how much money does a microsoft vp of finance make. This is another tax-advantaged pension that enables for amazing development and savings. Unlike your 401k, however, this account leverages after-tax income.

AMAZING. Like your 401k, you're going to want to max it out as much as possible. The amount you are allowed to contribute goes up sometimes. As of 2019, you can contribute approximately $6,000/ year. I recommend putting cash into an index fund such as the S&P 500 as well as an international index fund too.

: If you do not understand where to find the cash to invest in these accounts, discover how you can save a lot of cash with. If you're stressed about your personal finances, you can enhance them without even leaving your couch. Check out my Ultimate Guide to Personal Financing for tips you can implement TODAY.

The 2nd best time is today. I know, I understand. I seem like a tacky inspirational poster but the adage is real. If you wish to purchase a home or a good vehicle one day, you do not desire to think of where you're going to get the cash the day you prepare to buy it.

About How To Make A Lot Of Money In Finance

That's why I'm a HUGE proponent of. There are still people out there who have actually heard me harp on this for literal YEARS and still haven't automated their financial resources. And why not? For a few hours of work, you can conserve yourself countless dollars down the road. One factor lots of are averse to conserving money is because of the pain of putting our hard-earned money into our cost savings accounts each month.

It's a set-it-and-forget-it approach to your finances, allowing you to send out all of your cash precisely where you need it to go as soon as you get your income. After all, if you had to track your costs and move money into cost savings monthly, it would eventually be one of those "I'll get to that later on" things and you 'd NEVER EVER get to it.

That's why. You can start to dominate your finances by having your system passively do the best thing for you. Instead of thinking of conserving every day set it and forget it. To do this, you require simply one hour today to set everything up so your income is divided into four significant pails as quickly as it shows up in your checking account.

Like your 401k, you're going to desire to max it out as much as possible. The amount you are enabled to contribute goes up sometimes. Currently, you can contribute up to $6,000 each year.: Here, that you have actually created for long-lasting objectives like your wedding, vacation, or deposit on your home.

How Do Auto Finance Companies Make Money With So Many Shitty Applicants Fundamentals Explained

: Make automatic payments for recurring services like Netflix, Birchbox, and health club memberships using your charge card. You're going to have a lot of guilt-free spending cash in here for things like the periodic night out or fun purchases you wish to make. Make certain to log into your credit card's website and established automatic payments with your checking account so your charge card expense is paid off monthly.

: These are for costs that can't be paid off with a charge card, such as rent, electrical, water, and gas. When that money remains in your savings account, do not touch it unless you're all set to spend for your long-lasting goal (or if there's a HUGE emergency situation). To find out more on how to automate your financial resources, inspect out my 12-minute video where I go through the specific procedure with you.

Check out my Ultimate Guide to Personal Financing for suggestions you can execute TODAY. As soon as you automate your financial resources, you can enhance your cost savings by leveraging a sub-savings account. This is a savings account that you can produce within your regular cost savings account to conserve for particular purchases or occasions.

When the transfers remain in location, you're going to get a lot closer to your cost savings goals. AND you can do it without having to remember to set money aside. Take a look at all the various sub-savings accounts I had in my old cost savings account: ING Direct is now Capital One 360.

The 15-Second Trick For How To Make The Most Money With A Finance And Math Degree

I used the money I conserved to buy an engagement ring. So set up a sub-savings account and start immediately putting money into it every month. If you require help, take a look at my article to get going. This is an example of utilizing a system to make sure you have actually the cash required for an expensive purchase.

You can even set aside money for more nebulous things. See my "stupid mistakes." Or possibly you can have a "for when my friend demands 'simply another beverage'" account. Now, each time I desire to invest money on a pricey purchase, I KNOW I have the money. Since I have actually been saving a little bit at a time automatically.

If you're fretted about your personal finances, you can enhance them without even leaving your couch. Have a look at my Ultimate Guide to Personal Finance for suggestions you can implement TODAY. Target-date funds (or lifecycle funds) are a collection of assets that automatically rebalance and reallocate themselves as time goes on.

Target-date funds diversify based on your age. This implies the funds will immediately adjust to be more conservative as you get older. For instance, if you wish to retire in thirty years, an excellent target-date fund would be the Lead Target Retirement 2050 Fund (VFIFX), considering that 2050 will be close to the year you'll retire.